Chris’ Corner #3 - Inflation!

There have been a lot of articles popping up in my newsfeeds about inflation recently. I thought what a perfect topic inflation would be for this week’s Chris’ Corner. I imagine a lot of you readers may have learned about inflation the same way I did - that is my Grandpa rambling about how cheap things used to be in the old days a la Abe Simpson. These days it is impossible to buy a bag of chips and a pop for $0.10 but we also make a lot more than $0.40 an hour. Looking at the inflation data from the Bank of Canada graphed below we are in a high inflation period - but what does that mean for us?

Inflation in Canada

Inflation affects the buying power of your money. Let’s say you want to buy a $100 pair of shoes, but you have to wait one year to buy them. The inflation rate for that year is 5% - maybe there was some shock to the system, like gas prices increasing enough to make transportation more expensive. Come next year, that exact same pair of shoes is, in fact, $105. Well, you don’t like the fact shoes are now $105 instead of $100, so you say to your boss, the manager of the brewery you work at:

“I need a raise now! I can no longer pay for the same lifestyle I once had and may look for a higher paying job.”

Your boss agrees to give you a 5% wage increase bringing you back to the lifestyle you are used to. Now the brewery you work at has increased the cost of its operations by giving you a raise. While companies may have enough profits to cover the difference, they probably won’t, it is hard to imagine a company being OK with a drop in their earnings. So the brewery now charges a little bit more per beer to cover the increased wages. This cycle goes on and on repeating in all different types of industries. Prices get high, workers ask for more wages, prices get higher, workers ask for more wages, and so on. We have gotten pretty good at setting ourselves up for 2% inflation each year, but throw in some sort of a crisis and things can change quickly.

How can you protect yourself from inflation? You could take my word for it, but maybe it is better if Elon Musk & Warren Buffett show you.

Let’s break down what Uncle Musky & Mr. Buffett are saying here. Essentially what it all boils down to is this - don’t put money under your mattress; your money should work just as hard as you do!

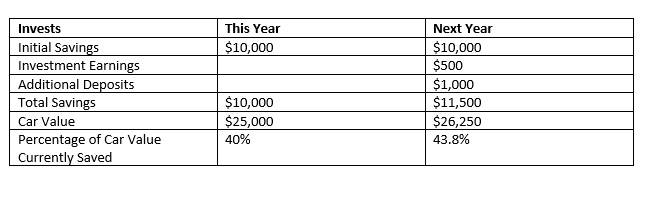

Let’s compare someone who invests their money at 5% interest rate & someone who does not and they both are saving for a $25,000 car- let’s say that inflation is 5%, they both have $10,000 of savings and contribute $1,000 to their savings every year.

The percentage saved for the person who doesn’t invest went from 40% to 41.9%, while the person who did invest - even though the gain from investment is the same as inflation - their savings percentage went from 40% to 43.8%. Now, this might seem like a small difference, but over a number of years, this difference just keeps getting bigger and bigger.

Investing is a great way to protect yourself from inflation. While the value of a dollar may be less and less each year, your earnings on those dollars will help to protect your hard-earned money.

If you are looking to invest your money and are not too sure where to start, send me an email at chris@porterouge.co or visit our investments page and we will help you get started!