Chris’ Corner #4 - Is that investing or gambling?

As some of you may already know, I am not much of a fan of FinTok - the financial side of TikTok. The term “invest” gets thrown around a bit willy-nilly on these FinTok videos. There is a difference between investing and speculating, and today I hope to help you decipher what a good investment is and what is just speculation.

“Invest in my harebrained scheme, and you will be sure to make it to the top!” - Speculation.

“Invest in a low volatility ETF, and your capital will grow over time.” - Investing.

The main difference between the two is risk. If you have read any of my previous Chris’ Corner blogs, you may have heard me explain risk in a number of different scenarios. What it all boils down to is the variability of a return. The more extreme the returns, the higher the risk. A stock that usually moves between 3% to 6% is a lot less risky than one that moves -10% to 20%.

One of the things that you hear in probably every finance class ever given at Universities far and wide is, “There is no such thing as a free lunch!” That is very much true; investing and speculating both require that your hard-earned dollars be put in danger for the chance of a potential reward. However, there is a big difference between investing in an ETF that has positions in several different blue-chip stocks and investing in Tesla because your cousin's best friend knows a guy who is tight with Elon, who says they have big things coming. While both opportunities required money to be invested, the likelihood of your money not just disappearing one fateful day is much less likely when your money is invested and not speculated. If you believe stocks only go up, like many on Reddit will have you believe, you are going to have a bad time! The market taking a significant down-turn is not unheard of; these are four that happened just in the last 35 years.

1987 Black Monday

2000 Dot-com Bubble

2008 Financial Crisis

2020 Coronavirus Crash

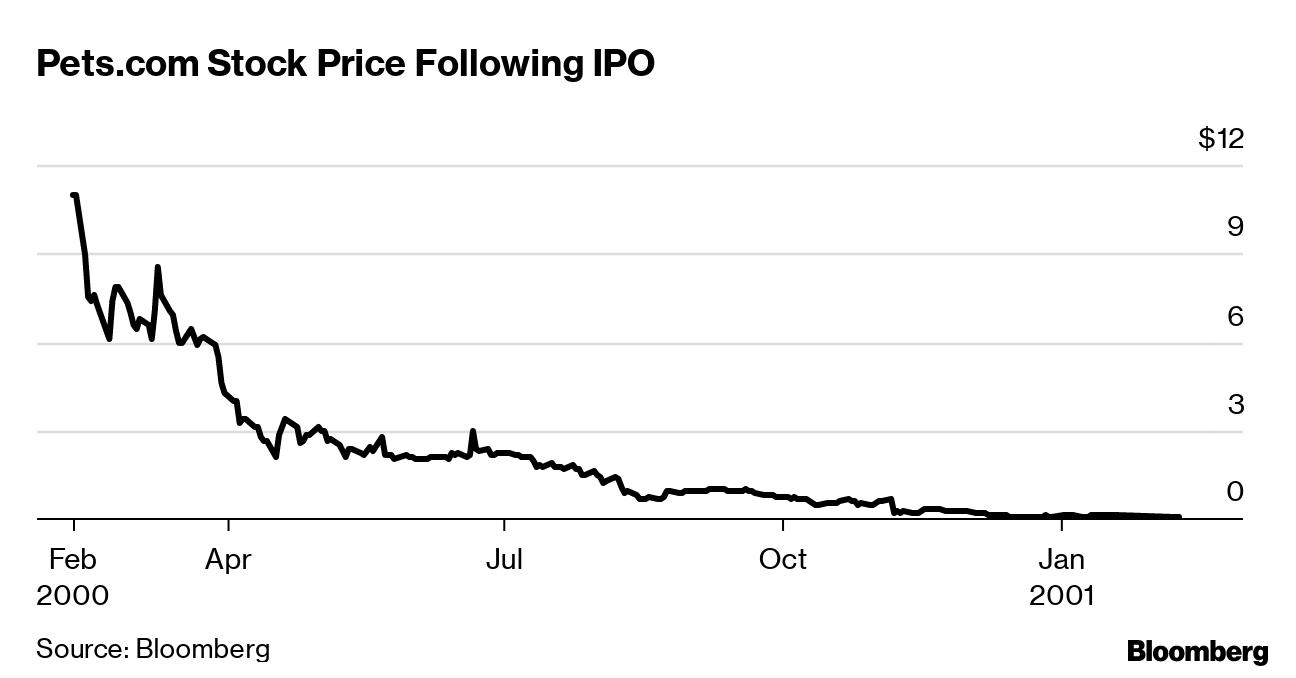

If you have money invested in many different companies in several industries, a market crash is easier to survive. Let’s look at the Dot-com Bubble of the early 2000s. Below you will see the stock price of Pets.com, Microsoft, and the S&P 500 from 2000 to 2001

Microsoft

S&P 500

Imagine you’re at the office water cooler in Feb 2000, right before the Pets.com IPO, and you and two coworkers are talking about your portfolios. One of your coworkers, PETricia, says, “I heard Pets.com will be the only pet store that matters; someone on Myspace said so!” She put $1000 into Pets.com. Another coworker named MIChael says, “I believe so much in Bill Gates’ vision that I put all of my money into Microsoft!” all of their money amounted to $1000 to make the math easier for me. Then you say, “I am not one to speculate, but I do like to invest my money in the markets.” You put $1000 into an S&P 500 index fund.

PETricia will lose her entire investment as Pets.com goes defunct.

MIChael will lose 55.69% of his investment, leaving him with $443.10

You are living the investing dream! The market may have had a terrible year, but you only lost 5.31%! You still have $946.80 at the end of the year!

While sometimes people have insane amounts of luck speculating, that is usually not the case. Some people win big on slot machines, but when most people go to slot machines, they don’t expect to win the enormous jackpot; I know if I come out $20 ahead, I feel great at the casino. Investing may not be as exciting as speculating, but these are your hard-earned dollars we are talking about, and preserving your money is just as important as growing it. When building a fund to retire with, going down 5.3% is a lot easier to come back from than losing 55% or all of it!

Time in the market is the number one way to make money investing. There is no magic trick or super equation, just time. If you are looking to start investing your money, feel free to reach out to me at chris@porterouge.co or check out our services page. We are here to help you grow!